The steps to buying a house can seem exhaustive, even if you have already been through the process. For first-time home buyers, these steps can get confusing very easily. It's hard to remember each step of the process when you're in the emotional roller coaster of buying a home. I created this article as a reference to help you through the process as you go through each step.

STEP 1: GET PRE-APPROVED FOR A MORTGAGE

This is everyone's lease favorite step of the home buying process, but it is the

foundation that the whole process relies

on. How can you know what price range to focus your home search efforts

if you do not yet know how much home you can afford. It can be very

disheartening to fall in love with homes in the $300,000 price range,

only to get approved for a maximum $200,000 loan later (trust me, it's

common). Before you get attached to any certain price range of home, you

need to know your financial position, and that starts with the mortgage

pre-approval.

Talk to a Good Loan Officer

Talking to a loan officer is very important. Notice I said "talking"

to a loan officer. in my experience, you will usually get the best

response from a mortgage loan officer if you contact them directly by

phone. Some may respond well by email, but most officers want a hear a

live voice before they will put much effort into your loan. You're

probably wondering,

"where is the best place to find a good loan officer?" My

advice is to network with a good Real Estate Agent. Good Realtors work

with hundreds of loan officers and keep the contact information of great

ones as referrals for future use. Realtors do not get paid for

referring a loan officer. Their motivation for referring a good loan

officer is directly tied to their experience with that loan officer. In an effort to make sure that

every transaction is handled properly, a good Realtor will have some

top real estate professionals in their contacts. If you live in central Iowa

and you need help with this, I can send you a list of a few highly

skilled loan officers that I have worked closely with.

Calculate How Much Home You Can Afford

Once you have found a lender who you are comfortable working with,

you can start planning based off of your loan officer's information.

First, you will determine the

sales price range you are

most comfortable with, based off of your approval and monthly payment

details provided by your lender. Determining the real estate price range

is the most important search criteria to know when starting your home

search. Once you have determined this amount, you can also calculate

your

down payment and

closing costs. These numbers will vary as you work through the loan details with your lender.

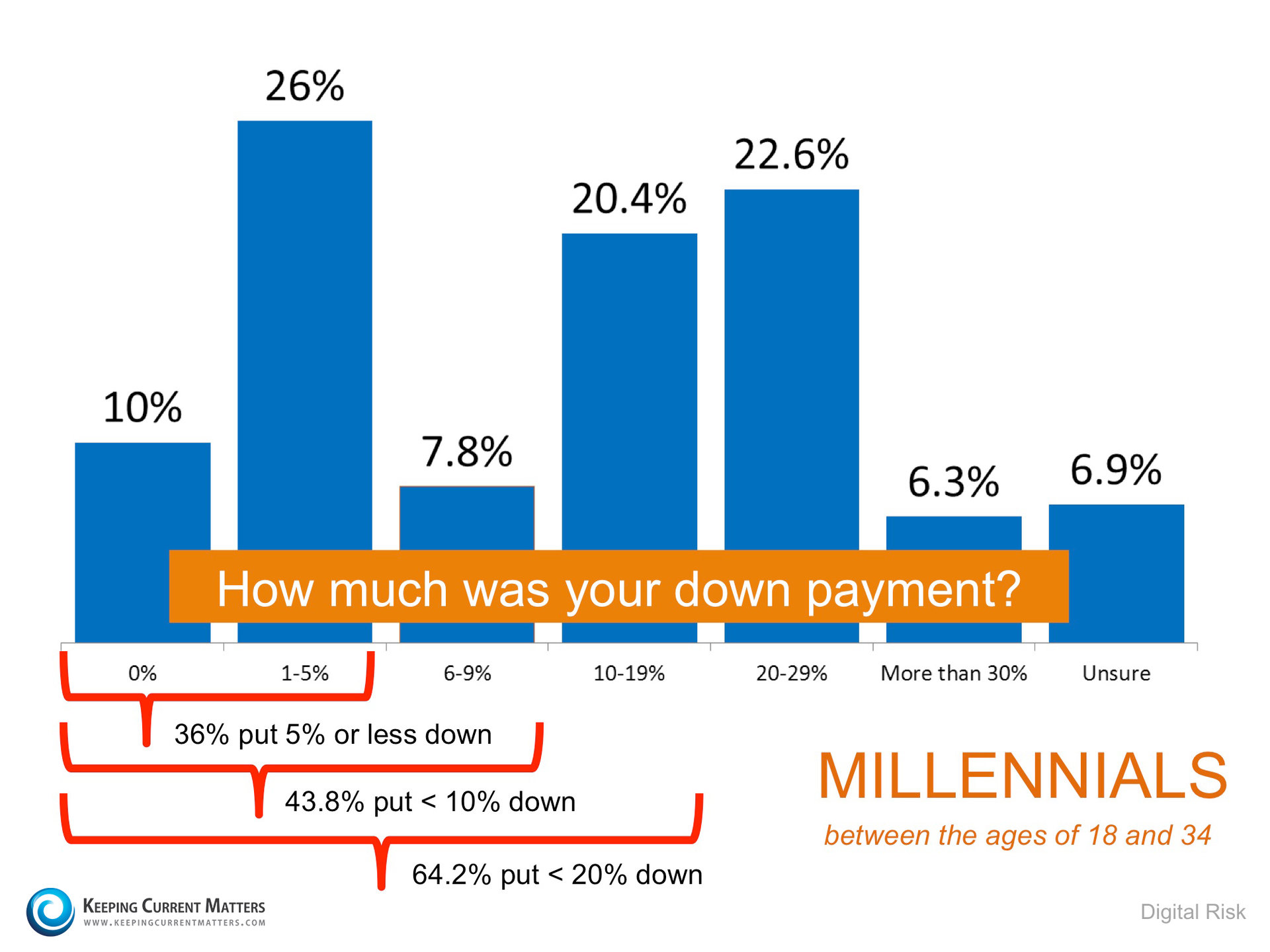

FHA loans require a minimum of 3.5% down and

can have slightly higher closing costs than conventional loans.

Conventional loans usually require a minimum of 5% down, but may have

lower closing costs. VA loans and USDA loans require no money down, but

usually have the highest closing costs and have much more strict

guideline requirements. These are all details that you can work through

with a loan officer during the first stages of your home search.

Obtain a Copy of Your Pre-Approval Letter

Once you're past the pre-approval stage, you can start your home

search. In order to be taken seriously by any Realtors, Home Builders,

For Sale By Owner sellers, etc., you will need to

prove your buying power.

This is where you will shine, since you have already gone through the

pre-approval process (if you have taken the fore mentioned advice). Many

people want to look at homes and be treated as a serious buyer before

they have even talked to a mortgage lender. The most common question a

Realtor asks a potential buyer when they first meet is, "Have you had

the opportunity to speak to a loan officer yet?" If the answer in "No",

then the buyer will be directed to talk to a mortgage lender.

STEP 2: FIND A HOUSE

Now the fun begins! It's time to start shopping.

Research Area and Neighborhood Statistics

It's never been easier to find local information online. Data is

constantly being posted on forums, websites, and social media sites.

It's up to you to take advantage of this information to find the right

area for your next home. It's a good practice to research local school

districts, crime rates, taxes, pricing history, and any other relevant

information that you can find. Search

local online forums for one-on-one direct information from residents in the area. Use

real estate blogs and websites, such as this one, to find market statistics and data that is relevant to your search criteria.

Find A Good Real Estate Agent

A good Real Estate agent is invaluable. Imagine that you have bought

and sold 10 homes in your lifetime. You would probably feel more

knowledgeable than if you had only bought one home. This is the

value of a great Real Estate agent. When I work with buyers and

sellers, I am relieved when I have the pleasure to work with people who

value my knowledge of the industry, and they ask me many questions. It's

a great feeling to be able to share my experience with home

buyers and sellers.

Write A Strong Contract

Once you have found the house that you love, it's time to get it

under contract! A good Realtor will also help you structure an offer

well by writing a strong contract that protects your interests, as well

as entices the other party to accept your offer.

There are multiple ways to structure a contract. If

you need closing cost assistance to help you close, you will want to

make sure that you structure the numbers to still be appealing to the

sellers. If there are multiple offers on a property, you will need to be

coached on how each individual space on a contract can affect the

strength of your offer. The best properties sell fast, so writing a

strong contract can make, or break, your ability to find the best house

on the market within your search criteria. Once you have a signed

contract, you will want to hire and inspector to make sure everything in

the property is okay. Negotiate repairs if needed. Once you are past

the inspection period, it's on to the closing!

STEP 3: GET THE KEYS

Due to recent changes in financing regulations, it now takes about 45 days to close a transaction, from the time

of the executed contracted to the signing of the papers at closing. This

time is needed for the mortgage company to prepare the loan and get all

the documentation in order. Buyers paying with cash can close much

quicker, sometimes as soon as 10 days after the executed contract is

submitted. FHA, VA, and conventional loans all have different time

processes, of which your real estate professional should keep you

informed about throughout the home buying process.

Schedule the Final Walk-Through and Closing

It is wise to

do a final walk through just before

closing to make sure that there are no major issues with the property

before purchasing it. This is not an inspection period. That part of the

home buying process has already be completed upfront (hopefully). The

walk through is just to make sure that there are no HUGE issues that

would cause the transaction to be compromised. I have never had a walk

through go bad, but it is always a possibility that the house could be

in such bad condition, that the buyer would rather risk being sued for

breach of contract, rather than buy the property in it's current

condition.

Close The Transaction & Get The Keys!

On the day of closing, be sure to bring your photo ID (preferably

driver's license) and certified funds for the downpayment and other fees

that will be on the HUD statement. The lender should provide you

with the final cash-to-close amounts several days before closing. This usually takes about an hour. Upon completion,

you can have the keys and take possession of the property as the new proud owner(s).

Live Happily Ever After

Now that you have successfully bought your new home, make sure that

your taxes and insurance are escrowed properly on your first mortgage

payment (if applicable). Also, remember to file for your homestead

exemption (if applicable) to lower your tax rate.

Now you can move on with your life, make lasting memories and live happily ever after..... until it's time to sell. I'll cover that in another blog post.